Introduction

The Citizenship by Voluntary Tax Contribution Program (C-VTCP) represents an innovative approach to citizenship acquisition, combining the traditional model of Citizenship by Investment (CBI) with a flexible, long-term tax contribution commitment. The C-VTCP targets individuals who seek citizenship but are unable to make a one-time, high-value investment. Instead, these individuals commit to voluntary annual contributions over a period of time (e.g., 5 to 10 years) in exchange for the potential to acquire full citizenship.

This hybrid approach offers governments a sustainable, recurring revenue stream while expanding the pool of eligible participants beyond traditional high-net-worth individuals (HNWIs) to include entrepreneurs, professionals, and global citizens. It also enables governments to maintain fiscal flexibility, adapt to evolving market conditions, and ensure a steady flow of investment into their economies.

Program Overview

Core Principle:

The C-VTCP provides a pathway to citizenship in exchange for voluntary, long-term tax contributions. Participants can enter the program by committing to an annual tax payment, typically based on their global income or a fixed minimum contribution, over a period of 5–10 years. Depending on the specific terms, participants may receive conditional citizenship at the start of their commitment or full citizenship upon completing the contribution period.

Payment Structure: Participants agree to make annual payments (e.g., $50,000–$100,000) over a set number of years. Payments are typically tied to global income levels, ensuring fairness and adaptability.

Citizenship Grant: Citizenship may be granted at the beginning (conditional citizenship) or at the end of the payment period, contingent on the completion of the tax contributions.

Revenue Model: The revenue generated by the C-VTCP comes from ongoing tax contributions, potentially supplemented by additional fees for legal processes, administrative costs, and business-related applications.

Market Opportunity and Target Audience

The C-VTCP model addresses a growing demand for global mobility and access to more flexible citizenship opportunities, particularly among:

Entrepreneurs: Individuals starting or relocating businesses internationally who wish to benefit from favorable tax regimes and enjoy the advantages of global mobility.

High Net-Worth Individuals (HNWIs): Those who may be unable to pay large lump sums but can afford ongoing contributions.

Digital Nomads & Professionals: Individuals seeking long-term residency and citizenship in countries offering favorable tax structures, business environments, and lifestyle opportunities.

Families: Families seeking secure, high-quality education and healthcare systems, alongside global mobility and investment opportunities.

This broader demographic ensures that the C-VTCP model can attract a large volume of participants, which will directly impact both government revenues and economic integration.

Hybrid Model: CBI + C-VTCP

Incorporating the C-VTCP as a complementary offering alongside traditional CBI programs maximizes the appeal and potential revenue streams. While CBI programs target ultra-wealthy individuals who can afford large one-time investments, the C-VTCP caters to those who prefer flexible, recurring payments.

Key Features:

Dual Pathway to Citizenship:

Option 1: Immediate citizenship upon a one-time investment (traditional CBI).

Option 2: Conditional citizenship at the start of the program, granted upon fulfilling the tax contributions over 5–10 years (C-VTCP).

Flexible Contributions:

Participants choose between paying a lump sum or committing to annual payments based on their financial situation and long-term planning.

Revenue Diversification:

The hybrid model provides governments with both upfront revenue from CBI investments and long-term, predictable revenue from C-VTCP contributions, resulting in a balanced financial model.

Increased Participation:

The C-VTCP opens up participation to a broader group, including younger professionals, tech entrepreneurs, and families, allowing governments to access a new and larger revenue base.

Ethical Wealth Distribution and Integration

Voluntary Commitment vs. Transactional Citizenship: One of the key differentiators of C-VTCP is its focus on voluntary contributions based on taxation rather than the typical investment or purchase of citizenship. This is a core point and should be emphasized as a voluntary and long-term commitment to both the country and its economic growth, distancing it from the typical "transactional" model. This ensures that the program isn't perceived as "buying" citizenship.

Economic Integration: It’s important to emphasize how the participants' contributions tie into the long-term integration of applicants into the national economy, bringing their expertise, capital, and influence over an extended period, ensuring they are not just short-term contributors.

Flexible Pathways to Citizenship

The dual pathways (Immediate and Deferred Citizenship) should be more clearly outlined in terms of the benefits for both the government and the applicants. Immediate citizenship provides a higher initial tax revenue, while deferred citizenship builds long-term commitment, allowing governments to balance short-term revenue needs with long-term economic growth.

For instance, in deferred citizenship, the government is assured of continuous contributions, and participants benefit from long-term planning.

Benefits for Participants

Global Mobility:

Access to a powerful passport with visa-free or visa-on-arrival access to numerous countries.

Ethical Citizenship:

Contributing to sustainable development in the host country.

Tax Efficiency:

Transparent and predictable tax obligations under a single jurisdiction.

Economic Stability:

Secure investment opportunities and integration into a stable economy.

Host Country Benefits

Revenue Generation:

Boost in national revenue for infrastructure, education, healthcare, and social programs. High-net-worth individuals often bring additional investments in infrastructure, real estate, or technology sectors, creating jobs and opportunities that benefit the host nation beyond the direct taxes they contribute.

Global Investment Appeal:

Attraction of talent, innovation, and high-value businesses.

Positive Image:

Branding as a progressive, forward-thinking, and economically responsible nation.

Challenges and Mitigation Strategies

Perception of "Buying Citizenship":

Emphasize the voluntary, long-term commitment aspect to showcase it as earned citizenship.

Promote the program as a partnership rather than a transaction.

Compliance Risks:

Develop stringent vetting and monitoring mechanisms to prevent misuse.

Public Sentiment:

Engage in public awareness campaigns highlighting the program's benefits for national development.

Monitoring and Governance

Transparency and Accountability: While you briefly mention governance and auditing, a clearer breakdown of the accountability mechanisms in place will be critical. For example:

Independent auditing bodies should be emphasized, and participation in this system can be incentivized (e.g., allowing participants to see how their contributions have been used in the country’s development projects).

The audit process should include not just tax checks but also social impact assessments, ensuring that these contributions genuinely contribute to national welfare.

Proposed Operational Framework

Legal Framework:

Enact specific legislation governing the C-VTCP.

Align program rules with international tax transparency standards (e.g., OECD guidelines).

Application Process:

Preliminary screening for eligibility (background checks, financial integrity).

Commitment agreement signed with the host country, detailing tax obligations.

Monitoring and Reporting:

Annual audits of tax contributions by a licensed financial auditor.

Continuous residency and/or contribution checks to ensure compliance.

Post-Program Opportunities:

Alumni network for program graduates to foster further economic and social engagement.

Opportunities for advisory roles in national economic projects.

Pilot Program and Marketing Strategy

Given that this model is new, the Pilot Program should be more explicitly tied to a real-world test scenario. The pilot program could also target regions where digital nomads, tech entrepreneurs, or professionals are particularly active, ensuring that the model has both a practical application and scalability.

The Marketing and Outreach strategy should ideally highlight the global mobility advantage but also be centered around the ethical aspect of the program. This includes showcasing how applicants’ contributions can help to build sustainable economies and support social programs.

Public Perception and Sentiment

Public perception is a key challenge, as the model may initially be seen as a financial elite-exclusive program. A more robust communication strategy around how the program contributes to national interests, supports social welfare programs, and promotes transparent governance will be necessary.

Highlighting the long-term benefits for the nation, rather than just immediate revenues, is vital. For example, focusing on education, healthcare improvements, or infrastructure development will help engage the broader population.

Revenue Projections and Economic Impact

The introduction of the C-VTCP as part of a hybrid model with traditional CBI programs has the potential to significantly increase the revenue generated by citizenship schemes. The revenue from the C-VTCP will come from annual tax contributions, which are often more flexible and scalable than one-time investments.

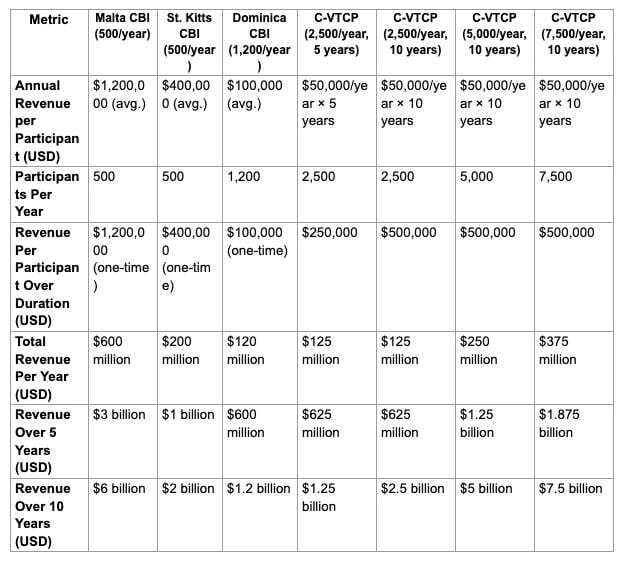

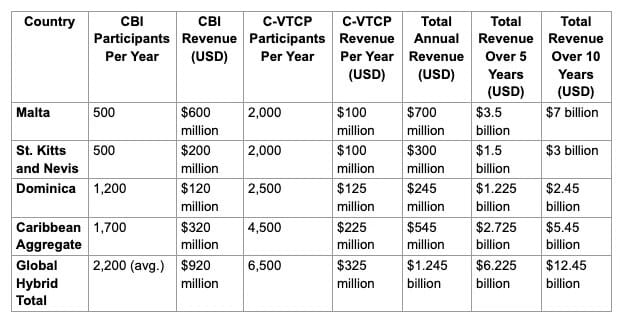

Expanded Revenue Projections Table: CBI vs. C-VTCP

Revenue Projections for CBI + C-VTCP Hybrid Model:

Indirect Economic Benefits

In addition to direct revenue, the C-VTCP model offers significant indirect economic benefits, including:

Business Relocation:Entrepreneurs may choose to relocate their businesses to the host country, creating new jobs, generating corporate tax revenue, and contributing to the overall economic growth.

Property and Real Estate Development:C-VTCP participants often invest in high-value real estate, which can drive property prices and boost construction and related industries.

Tourism and Services:Wealthy participants often contribute to the local economy through tourism, hospitality, and luxury goods consumption, providing further economic stimulation.

Knowledge Transfer and Innovation:Professionals and entrepreneurs relocating through C-VTCP bring expertise, innovation, and a global mindset, boosting the country's competitiveness in global markets.

Implementation and Legal Framework

Legal and Administrative Structure:Governments will establish a clear and transparent framework for C-VTCP, ensuring compliance with international tax laws, residency requirements, and citizenship policies.

Monitoring and Compliance:Governments must implement robust mechanisms for monitoring tax contributions, including international tax reporting, audits, and penalties for non-compliance.

Marketing and Outreach:Governments will develop targeted marketing campaigns focusing on the flexible, long-term nature of C-VTCP, appealing to individuals seeking a balanced approach to global mobility and economic opportunity.

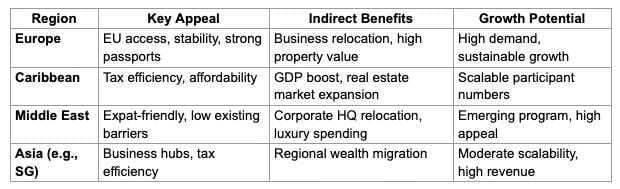

Key Regional Differentiators for C-VTCP:

Conclusion

The C-VTCP hybrid model represents a groundbreaking approach to citizenship and investment programs, offering flexibility, inclusivity, and long-term sustainability. By expanding access to global mobility and creating a recurring revenue stream for governments, the model stands to not only strengthen national economies but also attract a diverse group of participants from across the globe.

Governments should consider integrating the C-VTCP into their existing CBI frameworks to maximize the financial, economic, and social benefits. With careful implementation, the C-VTCP will become an attractive pathway for individuals and a powerful tool for national growth and development.

Created by https://www.linkedin.com/in/natalie-w/