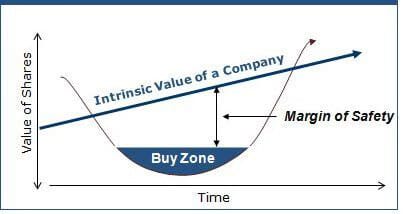

One of the most critical challenges investors face is determining the right moment to enter the stock market. Should you invest now, or is it prudent to wait? In this dynamic landscape, intrinsic value plays a pivotal role in making this decision.Here's how:1. Assessing Under or Overvaluation: By calculating a company's intrinsic value through methods like DCF analysis, we gain insights into whether its stock is currently trading below or above this true worth. If the market price is significantly lower than intrinsic value, it may signal a potential buying opportunity.2. Long-Term Perspective: Intrinsic value inherently encourages a long-term mindset. It serves as a compass, guiding us to focus on the enduring value of a company rather than being swayed by short-term market fluctuations. Investing with intrinsic value in mind can help us withstand market volatility.3. Risk Mitigation: Understanding a company's intrinsic value allows us to assess the margin of safety in our investments. When market prices align with or fall below intrinsic value, the potential downside risk is reduced, providing a degree of protection in turbulent times.4. Contrarian Opportunities: Market sentiment can sometimes be irrational, causing stocks to deviate from their intrinsic values. Savvy investors use these moments to capitalize on mispricing, buying undervalued assets when others may be hesitant.5. Continuous Monitoring: Intrinsic value is not static; it evolves with changing economic conditions and company performance. Regularly reassessing the intrinsic value of your holdings ensures you adapt to market dynamics effectively.In conclusion, while timing the market precisely remains an elusive endeavor, using intrinsic value as a guiding parameter can empower us to make informed decisions. It encourages a patient, rational, and disciplined approach to investing, aligning our portfolios with the long-term potential of the companies we choose to support.