The global financial landscape continues to evolve, shaped by economic shocks, technological advancements, and policy reforms. As we move into 2025 and beyond, U.S. equities are poised for sustained growth, driven by their innovation-centric ecosystem, robust private sector investment, and dynamic regulatory environment. In contrast, European markets, while significant in size and historical influence, face structural hurdles that constrain their competitive edge. This article provides an in-depth analysis of why U.S. equities will outperform their European counterparts in the coming years.

1. The Role of Innovation and R&D Leadership

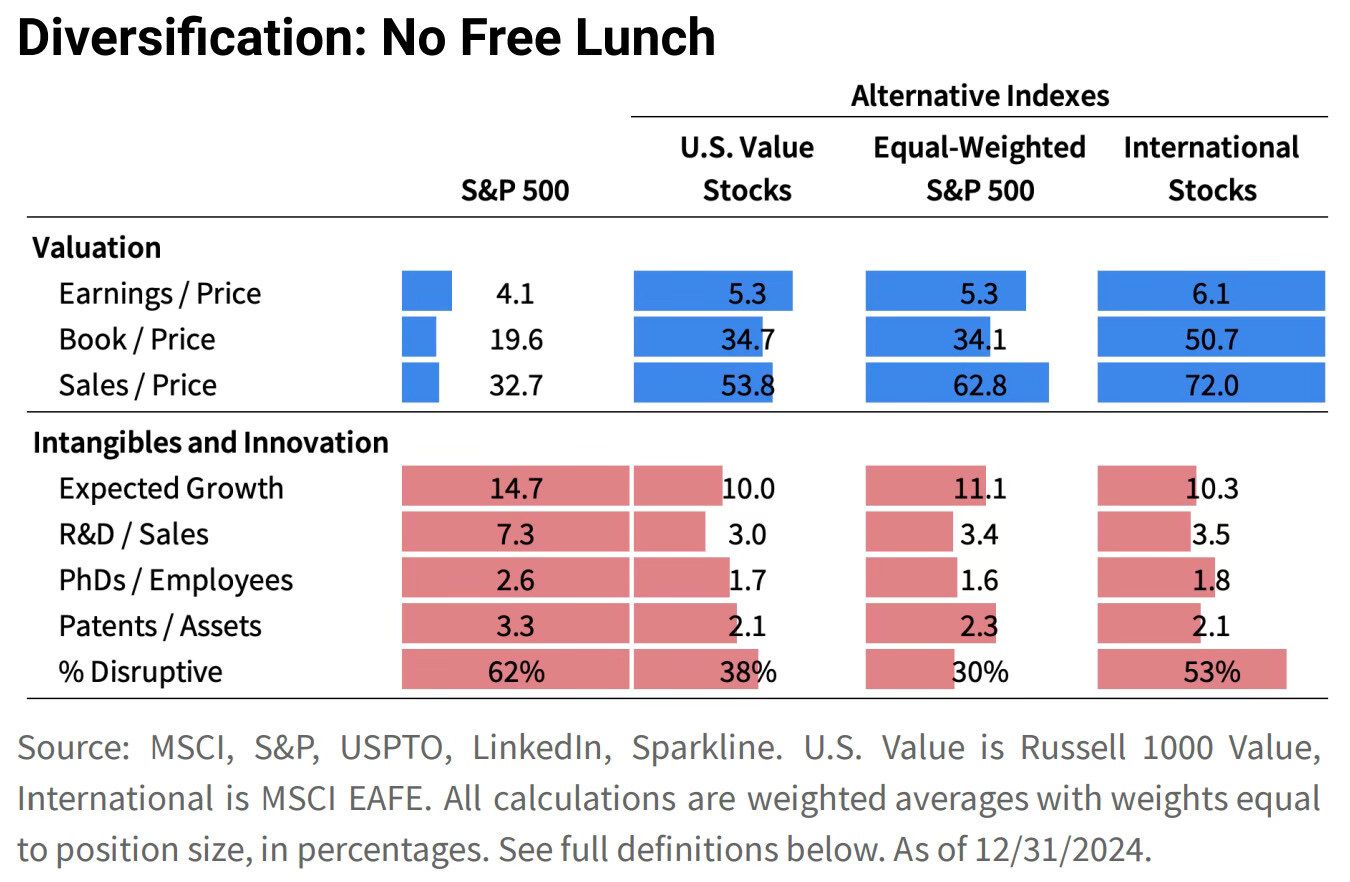

Innovation serves as the bedrock of economic growth and equity market performance. The United States has cemented its leadership in private-sector research and development (R&D), with companies such as Amazon, Alphabet, Microsoft, and Apple spearheading advancements in artificial intelligence (AI), biotechnology, and renewable energy. In 2022 alone, the top five U.S. tech companies invested over $200 billion in R&D—a figure unparalleled globally.

Europe, while competitive in certain sectors such as automotive manufacturing, lacks a similar scale of investment in high-growth industries. Research by Fuest et al. (2024) attributes 60% of Europe’s R&D spending gap to industry composition. U.S. firms dominate in R&D-intensive sectors, whereas Europe’s economy remains anchored to traditional industries with slower growth trajectories. If European economies were structured more like those of the United States, private-sector R&D spending would increase from 1.3% to 2.2% of GDP—closer to the U.S.’s 2.4%.

Insufficient investment compromises Europe’s competitiveness, way of life, and standing in the world. US investment in intellectual property and equipment is double that of Europe per capita, and Europe’s pool of venture capital assets is just one-quarter of the US total.

This disparity in innovation investment is reflected in tangible economic outcomes. For example, U.S. firms achieve faster revenue growth and superior returns on invested capital (ROIC), providing a compelling case for their long-term outperformance.

2. Market Capitalization and Intangible Asset Dominance

U.S. equity markets are characterized by their emphasis on intangible assets, such as intellectual property, software, and branding. These assets are integral to driving exponential growth in the modern economy. Companies like Tesla and NVIDIA exemplify this trend, leveraging their intellectual capital to achieve market dominance.

In contrast, Europe’s equity landscape remains tethered to old-economy firms in sectors such as banking, industrials, and automotive. While these industries provide stability, they lack the explosive growth potential of technology-driven sectors. For example, U.S. firms with over $1 billion in revenue invest an average of 6.8% of their revenue into R&D and achieve a 17.8% ROIC. European firms, by comparison, invest just 3.7% and generate a 14% ROIC. This gap underscores the competitive advantage of U.S. markets.

3. The Venture Capital Ecosystem: A Catalyst for Growth

Venture capital (VC) plays a pivotal role in fostering innovation and scaling new businesses. The U.S. VC ecosystem, representing 0.32% of GDP, far outpaces Europe’s 0.05%. Institutional investors in the United States, including pension funds and endowments, actively participate in venture funding, enabling startups to scale rapidly and enter public markets.

Europe’s fragmented regulatory environment creates barriers for VC activity. Regulatory constraints under Solvency II and pension fund restrictions discourage high-risk investments. As a result, European startups secure significantly smaller seed rounds—an average of $115,000 compared to $500,000 in the U.S. This disparity limits Europe’s ability to cultivate global tech leaders.

Reforms aimed at boosting venture capital activity are critical for Europe. Simplifying regulations under the Alternative Investment Fund Managers Directive (AIFMD) and revising risk assessment frameworks could unlock much-needed private investment. However, these changes will require time to yield tangible benefits.

4. Regulatory Frameworks: Supportive vs. Stifling

A supportive regulatory environment is essential for market efficiency and innovation. U.S. regulators adopt a market-friendly approach, often acting on evidence of harm rather than potential risks. This philosophy fosters entrepreneurial activity and rapid technological advancements. Agencies like DARPA and ARPA-E exemplify this, channeling billions of dollars into high-risk, high-reward projects.

Europe’s precautionary regulatory approach, while aimed at minimizing risks, often stifles innovation. High-profile initiatives such as the Human Brain Project and Horizon 2020 have struggled with inefficiencies and mismanagement. The European Innovation Council (EIC) Pathfinder, designed to fund groundbreaking technologies, remains underfunded compared to U.S. counterparts. For example, its 2024 budget of €250 million pales in comparison to DARPA’s $4.1 billion allocation.

5. Macroeconomic and Demographic Dynamics

The United States benefits from favorable demographic trends, including a younger and more dynamic workforce. This demographic advantage translates into robust consumer spending, driven by wage growth and low unemployment rates. These factors create a fertile environment for corporate revenue expansion, particularly in consumer-facing industries.

Europe, on the other hand, faces significant demographic challenges. An aging population and slower labor force growth constrain economic expansion. High energy costs and geopolitical uncertainties further exacerbate these headwinds. These macroeconomic factors make European equities less attractive to global investors.

6. Technology and Startup Ecosystems

U.S. technology companies dominate global markets, with nine trillion-dollar firms compared to Europe’s none. The U.S. offers founder-friendly environments, high salaries, and streamlined startup processes, enabling companies to scale within months rather than years. In contrast, European startups face fragmented markets, lower funding levels, and extended timelines for scaling.

This difference is evident in key metrics: U.S. tech salaries range from $180,000 to $300,000, attracting top talent, while European salaries remain comparatively lower. Moreover, U.S. startups secure SAFE (Simple Agreement for Future Equity) investments early, enabling them to innovate aggressively without immediate revenue pressures.

7. Monetary Policy and Investor Confidence

The Federal Reserve’s proactive and balanced monetary policy supports growth without undermining inflation control. This responsiveness enhances investor confidence and stabilizes equity markets. In contrast, the European Central Bank (ECB) faces a more complex landscape. Persistent inflationary pressures and sluggish economic growth limit the ECB’s flexibility, creating uncertainty for European equities.

Conclusion: A Divergent Path Forward

The structural, regulatory, and economic advantages of the United States position its equity markets for sustained outperformance. The U.S.’s innovation-driven economy, robust venture capital ecosystem, and favorable demographic trends create a resilient foundation for growth. In contrast, Europe’s reliance on traditional industries, fragmented regulations, and demographic challenges constrain its market potential.

While Europe’s path to parity will require significant reforms and investment, the United States remains the clear choice for investors seeking growth and resilience. As the global economic landscape continues to shift, the divergence between U.S. and European equities underscores the critical importance of innovation, strategic investment, and supportive policy environments.

Take a look at the divergence in performance between Europe’s top-10 companies by market value and those in the US:

Update Jan. 13, 2025: US vs EU

Labor productivity based on output

Labor productivity based on employee compensation

Energy prices in the Euro area relative to the US

European manufacturing output by energy intensity

One-size-fits-all policy not well suited for Eurozone

Labor mobility, US vs Europe

Other than healthcare, US ROE and ROA higher than Europe across sectors

3 month earnings revisions trend

Decomposition of US equity outperformance vs Europe since 2009

Overweight US, underweight Europe

Creation of new public companies in the 21st century

Originally posted on LinkedIn.